2.13.16

PSEi : Where are we now ?! And where are we heading ?!

|

| PSEi |

The BiG ₱ICTURE :

From the ending week of August last year, the local market entered into a deep correction(red arrow, above pic), stay there for more than 4 months(consolidate between 7300 resistance and 6600 support), then touched bear market territories starting on the second week of January 2016, hitting as low as intraday 6084 on January 21,2016.

Rise up and broke the 6600 resistance again on January 29th stay there for 2 days, breach it on the third day, then broke it again the next day and stay up and close the 6600 and had successfully defended it for 5 consecutive trading days, showing resiliency amidst world market fears of recession and continued foreign capital outflow from the local bourse.

The TRuE ₱icture :

Questions ??... Where are we now and where are we heading ?!

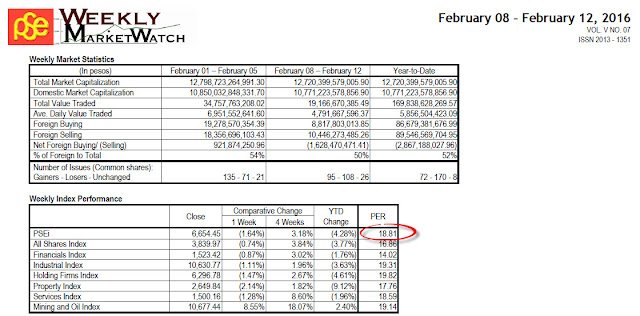

PSEi PE as of last week stands at 18.81 according to the latest Weekly Market Watch release to the public covering Feb 8-12. See pic below in red circle and we were down (4.28%) YTD...

Questions ??... What does PSEi PE of 18.81 means to an investor like me ?!

PE is a valuation tool use to gauge if the market is cheap or expensive, so at 18.18 where lies our overall market pricing ?! Expensive ? Cheap ?? What do you think ?!

Our PE when we reach the peak last year was... 23.20 (see pic below).

If we do the math, 23.20 - 18.81 = 4.39 down right now !

|

| PWM 41015 |

(4.39/23.20 ) We lost almost 19% on PE since it's peak (Just a little above the 20% bear territory) to date and does this means we are cheap now ?!

Before we tackle this nagging question, let us first revisit and examine 2008 bear market,

and how the prices behaved historically...

|

| 2008 Philippine Bear Market |

From the peak of 3896 - 2369 = 1527pts slide.

1527/3886 = 0.3929490478641276 or 39%

From the picture above,

So from the low of 2369 on 7.3.08 the market started a temporary rebound reaching the high of 2768, stay on that range (2768/2369) from July 3 to October 9 on the same year for a total of 3mos and 1 week.

Comparing data with today,

2008 bear made a temporary rebound lasting for about 3 mos. before sliding again to bottomed on 1730 (3896-1730 = 2166) losing 55% ! (2166/3896).

Present : The market appears making a temporary rebound from lowest(so far) 6084 to 6600 range just like the 2008 BM but this is just my personal view. The market has been so far more or less playing the 6600 range and successfully defended this support for 6 trading days do far.

Analysis : If the market can be defended by big local investment firm on a 6600 level, there is a big chance what we have is today is just a huge correction to the bloated price of our market. The inflated market valuation that shoot up to record breaking 23 PE ! Thanks, no thanks to US QE3...

What to expect :

Scenario one : The market will go south, the market rise is temporary... and the market will go into panic thus the power of the bear will win !

Scenario two : The market will go north, the market price will steady go up and the market shall go forward to reclaim another record.

Scenario three : The market will consolidate...

I personally pick number three.

Personal reasons.

I pray and hope scenario one will not transpire(syempre, always hoping it will be better).

The economy is doing well, presidential election is coming(election spendings will spurs economic activities), and most business are doing well if not going great. One great worry though are OFW remittances specially coming from ME.

Scenario three is far fetched though this is the scenario most investors wish to happen.

Why ? NFBS is still bleeding the market. YTD almost ₱3B leave PSEi.

Last year(2015), almost ₱60B foreign money(pic below) get out of our market that sum up to ₱63B so to be able to reach the apex 8127 we have to attract same level of foreign money more or less which is almost impossible right now with US Q3 on the way out.

If the Election results will bring confidence to the country,

my HULA analysis will be consolidation of the market on the range of 7000/6600.

Thus 18.81 PE Valuation of PSEi cheap or expensive ?

We will try to tackle this issue on my next blog...

CAVEAT !